Broadleaf: A low risk Saas transition offering 30%+ IRR

Niche mission critical Japanese software provider is set to start monetising the value it creates for its ecosystem, yet it is priced for distress.

Disclaimer:

This is not an investment recommendation. The below is for entertainment, discussion and educational purposes. Readers should assume that I have a position, interest or bias in anything mentioned. The information provided may be false. Investors are encouraged to do their own work before transacting in any securities mentioned. Investing in the stock market includes risk, including the risk of total loss. Please consult a financial advisor to discuss suitability and asset allocation strategy before investing in the markets. A full disclaimer is at the end of the memo. Please read it before proceeding.

Broadleaf

Market Cap: $270m

Quick Thesis:

Broadleaf is a dominant software provider to a niche industry – the Japanese Autos aftermarket. The company is undergoing a conversion from licence/on premise to a saas/cloud pricing/product model. As a result of being hammered by the market during the downwards part of the inevitable and planned cash flow J curve, Broadleaf is now priced to deliver a 30%+ 6 year IRR from successful execution of its saas transition out to 2028. A return of this magnitude (roughly a 7x) available from a relatively low risk pricing model transition to a customer base which has historically shown very strong stickiness and renewal rates, seems a highly asymmetric risk/reward opportunity. Without wishing to be hubristic, I find it almost impossible to generate justified downside from these levels excluding some sort of cataclysmic capital misallocation/ strategic misstep and loss of competitive advantage and market position. Even a poor execution of the strategy will lead to very healthy returns.

Company Introduction

Broadleaf has a deep history and industry acceptance within the aftermarket auto industry in Japan. In the 80s, they developed a centralised parts inventory management software. This software has evolved through time into different products & applications to support businesses in the value chain, but the key competency is within the classification and logistics of autos parts.

This value add to the ecosystem is best described by the BL Codes. Broadleaf has, since the 80s, run a product classification system which identifies every auto part sold by every manufacturer: 470m unique auto products in total. Broadleaf own the language required to buy & sell auto parts. And of course they also provide the ordering system and inventory management systems to facilitate industry players to flow these products around between each other, as needed.

Here are some company provided explanations/flow charts to visualise how the products work:

This rich legacy and unique competitive position is reflected in the company’s dominant position within auto parts dealers and less dominant (although still industry leading), position amongst auto maintenance shops, where they have penetrated their software.

Broadleaf is led by Kenji Oyama, who joined in 2006 from Being, having led their software investment arm, spending time in Silicon Valley in the 90s. Whilst US investors may find some aspects of a Japanese small cap like Broadleaf to be alien, I don’t believe there is any reason to think that management are not aligned nor skilled operators/capital allocators. My only observation is that IR comms are below what US investors would want and the company is perhaps more slow & deliberate than aggressive & dynamic.

Financial Model

The revenue model was until recently split between Platform and Application, roughly 50:50.

Platform revenues are recurring as users use the B2B auto parts inventory database software as well as parts ordering system. These are monthly or usage based fees.

Application revenues are the one-off licence fees for use of their business applications. These revenues are recorded lump sum in year 1 but they are for 6 year licence periods, before renewal. Historically the company has achieved 95% renewal rates at contract expiry, with the majority of cancellations due to business closure rather than churn to competitor.

Medium Term Plan

Broadleaf is transitioning its customers from the product/revenue model described above, to a cloud delivered saas pricing model. As 6 year leases expire, they will not renew them, but rather shift to a monthly paid, cloud delivered product.

This results in a huge drop of revenue from 20bn to 12bn in 2022, but then this will rebuild towards 30bn+ over 6 years, as the existing customer base reaches licence contract expiry and then renews onto the saas product.

Here are the financial implications of this strategy. I believe there is a greater than average visibility to these forecasts, vs other 6 year saas forecasts you might see, as these are reliant on slowly converting an existing customer base who historically have renewed their service 95% of the time.

The two main drivers of this growth in revenues and profits are the Saas subscriptions just mentioned, as well as the Ordering Platform (known as EDI and Settlement).

The ordering platform is targeting 4bn yen of revenue in 2028. However, there seems significant upside risk here given that it has the potential to be an industry leading marketplace in a 1trn yen market which is currently transacted over telephone, fax and in person. The ordering platform is currently only used by 28% of customers and a 50bn yen GMV. Below indicates Broadleaf’s strategy to roll out the adoption of the end to end ordering platform, which is an obvious incremental step to a core product centred around inventory management and parts supply chain. The ordering platform is not a big pivot or a parallel adjacency. It is natural evolution of the core product. The buyers and sellers are already somewhat captive and with the industry standard BL codes and software applications, there is no imaginable easier place to transact parts.

Given Broadleaf are in a prime position to create a scaled 2 sided marketplace in auto parts, there is meaningful upside to 4bn yen forecasted revenues in 2028, as illustrated in the GMV/Take rate sensitivity table below. These revenues likely have a contribution margin of >70%.

A summary of points with respect to financial model development:

- Broadleaf has had elevated capex for the last 2 years as they developed the cloud product. This will remain elevated for another 2 years then fade off.

- Broadleaf will stop renewing customers on new 6 year licences, shifting them instead to monthly saas. As such, revenue will roughly halve in 2022 and then rebuild from that base over the next 6 years, as their customers reach the end of their 6 year licence period and are then offered a monthly subscription.

- Gross margins should rise as incentives/discounts required to sign a 6 year deal are removed when moving to a subscription model.

- Broadleaf will roll out their parts ordering system as standard, aiming to become the dominant marketplace in this niche, with a GMV/take rate revenue model.

- As the business is fully loaded for opex, Broadleaf will be loss making for the next 2 years.

- However, opex does not need to rise over the forecast period to deliver the targets and therefore there is very large operating leverage.

- Some of the customers will choose to take the new product through a lease arrangement with a 3rd party, vs subscribing directly themselves. This will provide working capital, up front cash flows, which should enable Broadleaf to navigate the loss-making years without requiring equity/debt financing.

- Once the transition is fully complete, the business will generate roughly 50% higher revenues than pre transition and this will be all recurring and at much higher margins (cloud vs licence margins).

- Beyond 2028 (so not in the MTP numbers) Sales, marketing and administration expenses related to old licence products will be able to reduce.

I believe we are at the point of maximum pessimism and short-term financial pain. The next 6 months should be an inflection point where the market will digest the cut in revenue and then start to see the evidence of the renewals/new saas revenues, which should be growing rapidly for the next few years.

Thoughts on Valuation

Broadleaf has just announced that revenue will halve and the business will be loss making over the next 2 years and the market has sold down the stock by roughly 50% over the last few months.

The market seems to be completely focused on near term profits and ignoring the high probability value creation strategy that Broadleaf is embarking on.

The case in point for this is that Daiwa, the only broker, immediately slashed their target price 40% post release of the medium-term plan, which seems a view purely based on next year’s revenues and not the strategy underway.

One thing I like to see is if management teams are willing to invest now for a return later. The bread and butter of capitalism is to invest capital, take risk, execute and only then, earn a return. That is the true process of value creation, not financial engineering which seemingly creates value out of thin air.

The market gives some management teams carte blanche to do this, but it only seems willing to back certain personalities, and in general, the market does not enjoy or understand short term pain for long term gain. Hence the obsession with whether M&A is accretive in year 1, as if that really matters or indicates whether capital was allocated prudently.

The market is currently recoiling at Broadleaf’s eminently sensible and low risk value creation strategy and seemingly views the business as if it is deteriorating rapidly. This presents an opportunity given that in actual fact the management are full steam ahead upgrading the business along multiple axes simultaneously.

Anyway, let’s consider a negative case and a positive case.

In the negative case, let’s assume that the strategy flops and the business is only capable of producing profitability that was achieved historically. Broadleaf generated >4bn EBIT 4 times in the last 8 years, but let’s say 4bn is normalised. Let’s also take a historical average EV/NOPAT multiple of 15x.

In this case, we are still seeing 45% upside. The downside is extremely well protected. Not only are we not paying for the Saas transition. We are paying a distressed price for a business that is executing an extremely accretive strategy. We have the luxury of financial history, seeing that this is a feasible business capable of generating strong profits and cash flows. This isn’t a leap of faith on a new saas business model on 10x revenues. This is a proven business model on 2x temporarily depressed sales.

In the positive case, let’s assume they hit the medium-term plan guidance numbers with revenue to 32bn and EBIT margins rising to 40%. In this case, applying a 20x exit EV/NOPAT multiple in 2028 we achieve a 32.6% IRR to 2028 from today’s price. This IRR could be further boosted by a falling away of cloud product development capex in the mid-2020s and then a falling away of legacy opex items post 2028.

Forecasts:

Exit Multiple IRR:

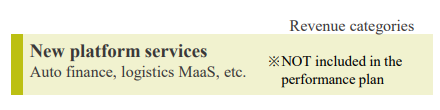

With prospective returns like that on offer, there is no reason to focus too closely on the optionality in the ordering system GMV/take rate and the other New Platform Services which the company is mooting, including an auto finance platform, because we simply aren’t even close to paying for it.

Risks

Despite my suggestion that this transition is low risk, premised on historical 95% retention on the 6 year licence deals, there is a chance that the customer base rejects the new product value proposition and we see significant churn and lower renewal rates.

We should be able to see in the next 1-2 quarters whether this risk is real or not. If the company can show that they moved 95% of expiring licences onto monthly Saas next quarter, I’d be pretty comfortable extrapolating that over the next 6 years given that the customers should be randomly distributed and there is no reason I can see why customer renewal behaviour should change over time. Also Broadleaf have spent the last 12 months preparing the customer base for this transition so hopefully it is not a shock.

I don’t see EVs as a risk to the industry on a 15-20 year view. This is a stock vs flow argument. The stock/fleet of autos will remain at least a large part ICU powered for the foreseeable future, even if sales of new vehicles start accelerating towards EVs. However, it is true that EVs contain far fewer parts than ICUs which reduces the need for auto parts. But frankly the stock price is too low to worry about long term industry degradation at this point.

Disclaimer: The preceding is for informational purposes only and presented “as is” with no warranty of any kind, express or implied. Under no circumstances should this report or any information herein be construed as investment advice, or as an offer to sell or the solicitation of an offer to buy any securities or other financial instruments. By downloading, accessing, or viewing any research report, you agree to the following Terms of Use. You further agree to do your own research and due diligence before making any investment decision with respect to securities of the issuers covered herein (each, a “Covered Issuer”) or any other financial instruments that reference the Covered Issuer or any securities issued by the Covered Issuer. You represent that you have sufficient investment sophistication to critically assess the information, analysis and opinion presented in the attached report. You further agree that you will not communicate the contents of reports and other materials made available to any other person unless that person has agreed to be bound by these Terms of Use. If you access, download or receive the contents of this report or other materials on your own behalf, you agree to and shall be bound by these Terms of Use. If you access, download or receive the contents of this report or other materials as an agent for any other person, you are binding your principal to these same Terms of Use. Myself and Related Persons have an interest in the securities discussed in this report. Investing in public securities involves risk, including risk of loss. In no event will I be liable for any claims, losses, costs or damages of any kind, including direct, indirect, punitive, exemplary, incidental, special or, consequential damages, arising out of or in any way connected with any information presented in this report. This limitation of liability applies regardless of any negligence or gross negligence of myself. You accept all risks in relying on the information presented

Cool idea. '17, '18, '19, '20 revenue doesn't seem to be growing too much. Why do they expect revenue growth after converting to SAAS?